Which Is the Better Investment, the Rolex Hulk or the Marvel Hulk?

Image Source: Time and Tide Watches

The Hulk vs The Hulk

At first glance the title might seem ambiguous, how could two of the exact same things be different from each other?

In this case I’m referring to two different Hulks, one being the Rolex Submariner 116610LV “Hulk” and the other being Marvel’s fictional Hulk character. It may be difficult to compare the two directly as we can’t put a value on the character of Hulk, so this will take a little mind-bending to form a comparison, please bear with me.

Image Source: Marvel

The character Hulk is part of the Marvel cinematic universe (MCU), which is currently owned by Disney. It’s hard to assign a value to the Hulk based on sales of Hulk branded apparel or screen appearances, and the same can be said for the whole of the MCU. Disney, however, is a publicly traded company (ticker: DIS), so we can use its stock price as a proxy for its valuation. At the time of this article, Disney stock has a price of $179.

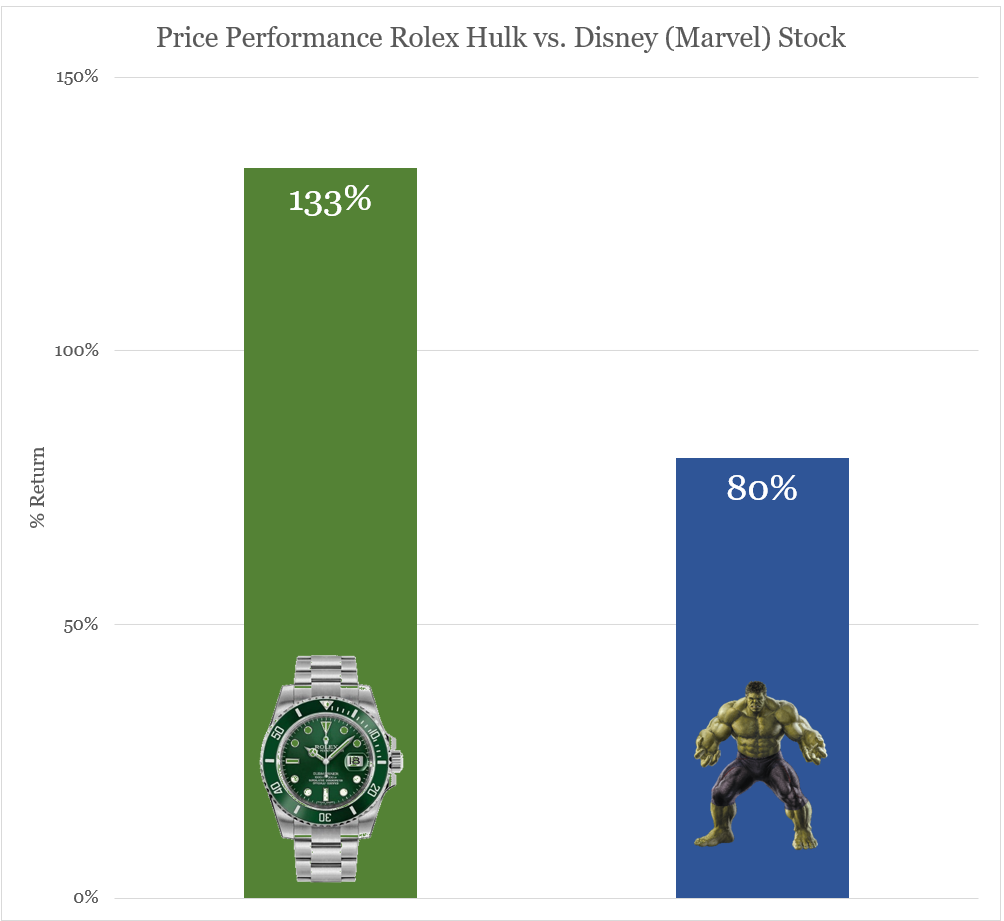

Assuming you purchased both Disney stock and a Rolex Hulk in 2015 (at MSRP), you would’ve spent $99.25 on Disney stock and $9,077 on the Hulk, to make the numbers more comparable, you could purchase 91 shares of Disney stock which would be $9,031, around the same amount of money that would be spent on the Hulk. Not including dividend payouts on the Disney stock, if you held both investments into 2020, the Hulk would now be worth $21,000 and the stock $16,289, solid gains on both. However, the Hulk would have returned 133% compared with 80% for the stock, clearly showing the resiliency of the watch.

Data Source: Chrono24

One thing to consider, however, is the risk of the asset. It’s hard to judge the riskiness of an asset like a Rolex watch, it’s most likely higher than that of a blue chip stock like Disney. While that’s not to say that a stock like Disney’s can't go down, and in-fact it did during the 2020 pandemic. In general, a stock like Disney will have steady, yet consistent growth due to the strength of the brand name (ask almost anyone in the world and they will have heard the name “Disney”). Disney, as a company, also has a wealth of diverse and varied income streams (Disney parks, streaming, merchandise, etc.); it’s very unlikely that all income streams would be negatively impacted at once. For example, during the pandemic, many Disney parks were shut down due to health concerns, but Disney+, its streaming service, saw meteoric growth as people stuck at home looked for sources of entertainment.

With watches, on the other hand, it’s much more difficult to point at factors that may influence their value, as they don’t generate any cash flow and much of their current popularity is attributable to social media fueled hype which may come and go based on fashion trends. Another downside of the Rolex is its illiquidity, or how difficult it is to sell. With modern brokerage software stocks like Disney can be instantly bought or sold with the press of a button, however, with watches it’s not so easy. Selling a Rolex takes time and incurs added costs such as: listing fees, escrow fees, shipping, etc. These fees all eat into the amount of money you ultimately receive for the watch after selling it, not to mention the additional time that must be spent to sell a watch.

Image Source: The Active Times

At the end of the day it’s not immediately clear which asset is better to invest in. While the Rolex offers larger returns over the time period we explored, it also comes with downsides when trying to sell and definitely when trying to buy. Disney stock on the other hand is much easier to sell and own while providing lower returns. At the end of the day, it’s up to you to decide which better fits your goals. You should also consider how both will perform in the future, with the reopening of the US economy and much of the world soon to follow Disney parks will most likely see increased visitor-ship which could propel the stock higher. On the other hand, the discontinuation of the Hulk and the hard-to-get nature of its successor, the “Starbucks” may also propel the prices of Hulks higher yet as collectors and enthusiasts attempt to get their hands on one.

Leave a comment